What Qualifies For Residential Energy Tax Credit . — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. The amount paid or incurred by the taxpayer for qualified energy. 1, 2023, you may qualify for a tax credit up to. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. — residential clean energy credit. Homeowners, including renters for certain expenditures, who purchase. Who is eligible for tax credits? if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. — the increased credit for a tax year is an amount equal to 30% of the sum of:

from sollunasolar.com

The amount paid or incurred by the taxpayer for qualified energy. — the increased credit for a tax year is an amount equal to 30% of the sum of: Who is eligible for tax credits? — residential clean energy credit. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. 1, 2023, you may qualify for a tax credit up to. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. Homeowners, including renters for certain expenditures, who purchase. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022.

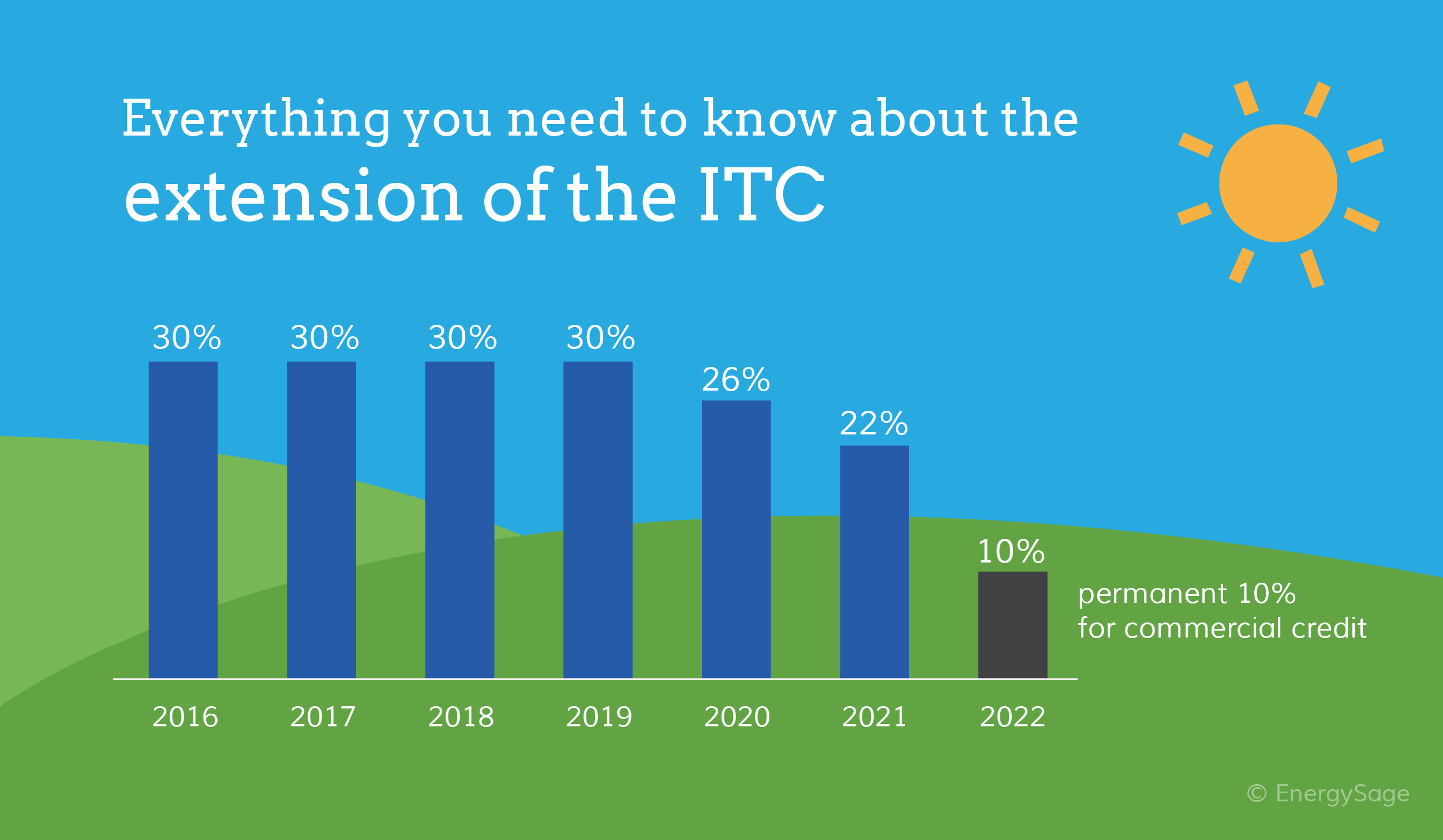

Solar Tax Credit Chart Energy Sage Sol Luna Solar

What Qualifies For Residential Energy Tax Credit if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. — residential clean energy credit. The amount paid or incurred by the taxpayer for qualified energy. 1, 2023, you may qualify for a tax credit up to. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. Homeowners, including renters for certain expenditures, who purchase. Who is eligible for tax credits? — the increased credit for a tax year is an amount equal to 30% of the sum of:

From eyeonhousing.org

New Residential Energy Tax Credit Estimates Eye On Housing What Qualifies For Residential Energy Tax Credit Who is eligible for tax credits? Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. — the increased credit for a tax year is an amount equal to. What Qualifies For Residential Energy Tax Credit.

From pioneerinstitute.org

Massachusetts Residents Are Opting to File for Residential Energy Tax What Qualifies For Residential Energy Tax Credit — residential clean energy credit. Homeowners, including renters for certain expenditures, who purchase. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. if you invest in renewable energy. What Qualifies For Residential Energy Tax Credit.

From www.youtube.com

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide What Qualifies For Residential Energy Tax Credit The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. — the increased credit for a tax year is an amount equal to 30% of the sum of: —. What Qualifies For Residential Energy Tax Credit.

From blueravensolar.com

Claiming Your Residential Energy Tax Credit Blue Raven Solar What Qualifies For Residential Energy Tax Credit Who is eligible for tax credits? — residential clean energy credit. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. The amount paid or incurred by the taxpayer for qualified energy. Homeowners, including renters for certain expenditures, who purchase. 1, 2023, you. What Qualifies For Residential Energy Tax Credit.

From fabalabse.com

What is energy property credit? Leia aqui What qualifies for energy What Qualifies For Residential Energy Tax Credit The amount paid or incurred by the taxpayer for qualified energy. — the increased credit for a tax year is an amount equal to 30% of the sum of: — residential clean energy credit. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential.. What Qualifies For Residential Energy Tax Credit.

From eyeonhousing.org

Use of Residential Energy Tax Credits Increases What Qualifies For Residential Energy Tax Credit Homeowners, including renters for certain expenditures, who purchase. 1, 2023, you may qualify for a tax credit up to. — the increased credit for a tax year is an amount equal to 30% of the sum of: if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify. What Qualifies For Residential Energy Tax Credit.

From farrandwdasya.pages.dev

2024 Irs Form 5695 Leila Natalya What Qualifies For Residential Energy Tax Credit — the increased credit for a tax year is an amount equal to 30% of the sum of: The amount paid or incurred by the taxpayer for qualified energy. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify for an annual residential. — residential clean. What Qualifies For Residential Energy Tax Credit.

From www.cielpower.com

2015/2016 Federal Energy Efficiency Tax Credit — Ciel Power LLC What Qualifies For Residential Energy Tax Credit The amount paid or incurred by the taxpayer for qualified energy. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. 1, 2023, you may qualify for a tax credit up to. Homeowners, including renters for certain expenditures, who purchase. The residential clean energy (rce) credit. What Qualifies For Residential Energy Tax Credit.

From www.solar.com

Federal Solar Tax Credit Take 30 Off Your Solar Cost What Qualifies For Residential Energy Tax Credit — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. The amount paid or incurred by the taxpayer for qualified energy. 1, 2023, you may qualify for a tax credit up to. — in general, the residential clean energy property credit is a 30% credit for certain qualified. What Qualifies For Residential Energy Tax Credit.

From www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy What Qualifies For Residential Energy Tax Credit Who is eligible for tax credits? — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. if you invest in renewable energy for your. What Qualifies For Residential Energy Tax Credit.

From thewealthywill.wordpress.com

“Get Tax Credits for EnergyEfficient Upgrades with the Residential What Qualifies For Residential Energy Tax Credit — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. The amount paid or incurred by the taxpayer for qualified energy. — residential clean energy credit. Who is eligible for tax credits? — in general, the residential clean energy property credit is a 30% credit for certain. What Qualifies For Residential Energy Tax Credit.

From portal.perueduca.edu.pe

What Is The Irs Energy Tax Credit For 2023 Printable Templates Protal What Qualifies For Residential Energy Tax Credit — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. The amount paid or incurred by the taxpayer for qualified energy. Homeowners, including renters for certain expenditures, who purchase. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by. What Qualifies For Residential Energy Tax Credit.

From www.actblogs.com

How To Get The Most Out Of The Residential Energy Tax Credit ACT Blogs What Qualifies For Residential Energy Tax Credit The amount paid or incurred by the taxpayer for qualified energy. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. — in general, the residential clean energy property credit is a 30% credit for certain qualified expenditures made by a taxpayer for residential. — if you invest in renewable. What Qualifies For Residential Energy Tax Credit.

From sollunasolar.com

Solar Tax Credit Chart Energy Sage Sol Luna Solar What Qualifies For Residential Energy Tax Credit The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. 1, 2023, you may qualify for a tax credit up to. The amount paid or incurred by the taxpayer for qualified energy. Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. — if you invest in. What Qualifies For Residential Energy Tax Credit.

From www.westcoastsolar.com

Solar Power System Sacramento Want Solar Panels For Your House? Ask What Qualifies For Residential Energy Tax Credit The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. Who is eligible for tax credits? — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. 1, 2023, you may qualify for a tax credit up to. if you invest. What Qualifies For Residential Energy Tax Credit.

From www.formsbank.com

Instructions For Application And Verification Form For Residential What Qualifies For Residential Energy Tax Credit — residential clean energy credit. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. 1, 2023, you may qualify for a tax credit up to. if you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or battery storage technology), you may qualify. What Qualifies For Residential Energy Tax Credit.

From nrgcleanpower.com

Solar Tax Credit What You Need To Know NRG Clean Power What Qualifies For Residential Energy Tax Credit — residential clean energy credit. — if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage. Homeowners, including renters for certain expenditures, who purchase. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. 1, 2023, you may qualify for a. What Qualifies For Residential Energy Tax Credit.

From novapublishers.com

Residential Energy Tax Credits Elements, Analyses and Design Issues What Qualifies For Residential Energy Tax Credit The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022. Homeowners, including renters for certain expenditures, who purchase. The amount paid or incurred by the taxpayer for qualified energy. — residential clean energy credit. 1, 2023, you may qualify for a tax credit up to. — if you invest in. What Qualifies For Residential Energy Tax Credit.